Contents:

Investing in stocks means buying shares of ownership in a public company. To learn more about our rating and review methodology and editorial process, check out our guide on how Forbes Advisor rates investing products. The Charles Schwab website is easy to navigate, and support features are displayed front and center, rather than tucked away in an obscure corner as is the case with many brokers. The Ascent is a Motley Fool service that rates and reviews essential products for your everyday money matters. The term is often used interchangeably with “brokerage,” which is technically the name for a business that employs brokers or acts as a broker to facilitate trading. Many or all of the products here are from our partners that compensate us.

Interactive Brokers’ mobile app is also easily customizable, which can make for a better trading experience as you develop a strategy. A number of stock brokers for beginners specialize in helping you learn about the market. The following brokers are particularly easy to use, which is why they’re recommended as the best stock brokers for beginners. Cash and securities in a brokerage account are insured by the Securities Investor Protection Corporation , so you have protection if your broker goes bust.

The Best Online Stock Trading Classes of 2023

Have a look at the recommended best online stock broker for beginnersing list on our sister site, StockTrader.com, to get a headstart. Full BioMaddy Simpson is an experienced data journalist and fact-checker with a background in financial analytics. To learn more about our rating and review methodology and editorial process, check out our guide on How Forbes Advisor Rates Investing Products. Both the web-based platform and thinkorswim platform are easy to use with an intuitive layout. Schwab also provides the benefits of an extensive branch network across the United States, where clients can schedule one-on-one sessions with a financial professional.

NerdWallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances. Examples are hypothetical, and we encourage you to seek personalized advice from qualified professionals regarding specific investment issues. Our estimates are based on past market performance, and past performance is not a guarantee of future performance.

NerdWallet strives to keep its information accurate and up to date. This information may be different than what you see when you visit a financial institution, service provider or specific product’s site. All financial products, shopping products and services are presented without warranty. When evaluating offers, please review the financial institution’s Terms and Conditions. If you find discrepancies with your credit score or information from your credit report, please contact TransUnion® directly. If you’re saving for a goal other than retirement — or you’ve topped off your 401 and IRA contributions — a taxable brokerage account is a good option.

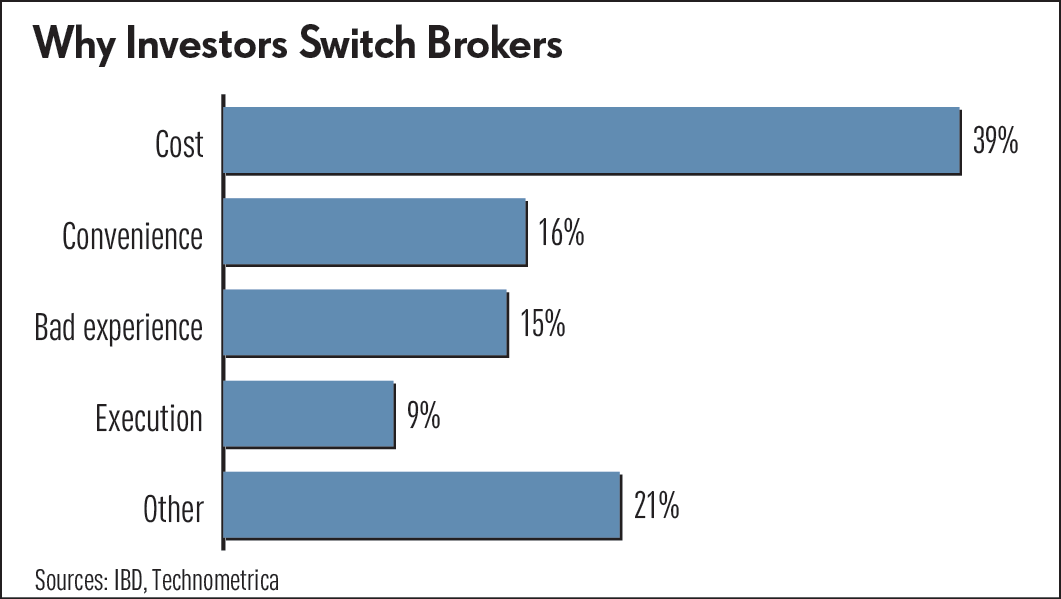

Other factors — access to a range of investments or training tools — may be more valuable than saving a few bucks when you purchase shares. However, most still require a minimum amount of money to use more complex features, such as margin investing. And $0 commission typically applies to stock and ETF trades; some brokers charge commissions for trading options and mutual funds, among other products. Take a look at a broker’s full fee schedule before you open an account to make sure it makes sense for how you intend to invest.

Investors can also connect with corporate founders and CEOs through live “Town Hall” meetings. While TWS users can still select the original view, they can build their own bespoke view through Mosaic. Functions such as stock monitoring, order entry, charts, and more appear as “tiles,” sized and arranged however you want them, and you can save custom layouts designed for one or more monitors. By clicking this link and using this product or service, we earn a commission at no additional cost to you.

Stock investing is filled with intricate strategies and approaches, yet some of the most successful investors have done little more than stick with stock market basics. While fretting over daily fluctuations won’t do much for your portfolio’s health — or your own — there will of course be times when you’ll need to check in on your stocks or other investments. If you go this route, remember that individual stocks will have ups and downs. If you research a company and choose to invest in it, think about why you picked that company in the first place if jitters start to set in on a down day. Making the right choice for a stock broker takes some insight into what to look for. Here are the top factors to look for in stock brokers for beginners.

To open an account, then, you’ll need to provide information so the firm knows who you are and how much experience you have investing. Some online brokerage firms have account minimums that range from several hundred to several thousand dollars. However, the top online brokers that we’ve listed here allow users to open an account with no minimum balance required. Look for a broker that can assist your decision-making and development as an investor with quality research and educational materials.

What causes stock prices to change?

Newcomers to investing and trading need dependable, friendly and informative customer service for help. We thoroughly tested the support at each of the brokers in our survey via phone, live chat and email. Finally, we made sure that our recommended brokers for beginners offer $0 commissions, competitive fees and low minimum account balances. Generally speaking, the safest investment choice for new investors is investing in funds. But you may also want to build your knowledge base on how to start investing in stocks. At some point, you may want to try your hand at individual stocks, and you’ll need to fully understand what it is you’re getting into.

Popular features among professional day traders, such as “hot keys,” are also available. With $0 commissions the new norm among discount brokers, identifying the players that offer the best value is more challenging. The process for opening a traditional IRA account or Roth IRA account is no different.

Robinhood is a commission-free brokerage platform that was founded in 2013 and is based in Menlo Park, California. The platform is known for its user-friendly mobile app, which allows investors to buy and sell stocks, ETFs, and cryptocurrencies with no commission fees. One potential downside of Fidelity is that it doesn’t offer commission-free trading on all securities. While the company does offer a large selection of no-fee mutual funds and ETFs, some investors may find that they need to pay commissions on certain securities. A company known as a discount broker allows investors to buy and sell securities through the internet. Customers have the option of controlling the stock purchase and sale process or opening an account with a robo-advisor to have their transactions made automatically.

What Are Online Stock Trading Classes?

Fidelity offers $0 trading commissions, a selection of more than 3,300 no-transaction-fee mutual funds and top-notch research tools and trading platform. Its zero-fee index funds and strong customer service reputation are just icing on the cake. Though it started out as one of the original discount brokerage firms, Charles Schwab has grown to be the largest retail investment broker in the world. Not only do they charge no fees for investing in stocks, options, and ETFs, but they also offer plenty of other benefits for investors.

So, when you’ve learned enough to begin, your trading account is set up and ready to go. With a variety of courses available without a membership and affordable membership fees, Bullish Bears is our pick as the online stock trading course with the best value. Udemy offers a wide range of beginner stock trading courses at remarkably low prices, making it our choice as the best course provider for newbies. Its affordable prices make Udemy an attractive choice for anyone who wants to see if stock trading is for them without committing too much. Once you open an account, all it takes to get started is enough money to cover the cost of a single share of a stock and the trading commission, if charged.

Many provide educational materials on their sites and mobile apps, which can be helpful for beginning investors. Robinhood also offers fractional share investing, which allows investors to buy and sell partial shares of stocks and ETFs. This is particularly useful for investors who want to invest in high-priced securities but don’t have the funds to buy full shares. In addition to its low fees, Fidelity is known for its excellent customer service. The company has a large network of branches throughout the United States, making it easy for investors to get in-person assistance with their accounts. Fidelity also has a robust online platform that allows investors to manage their accounts and trade securities online.

The scoring formulas take into account multiple data points for each financial product and service. Kevin Voigt is a former staff writer for NerdWallet covering investing. He previously was a reporter with The Wall Street Journal and business producer for CNN.com in Hong Kong, where he was based for nearly two decades. @ Mike Dividend investing is fun especially if you’ve got a few years under your belt to see how dividends can actually grow your account. The good news is that they let you play with $100,000.00 paper money to get acquainted with the site, which is what I am doing now before I ever fund the account. One way I can relate is the CPA I’ve been using for the past 10 years.

TD Ameritrade is among the best investing apps for people of all experience levels. But some massive changes are afoot that would-be new TD users should know about before diving in. No account minimums, no maintenance fees with both IBKR Lite and IBKR Pro. Beginning investors can use Plynk™ to start investing for as little as $1. To assist with building your financial literacy, Plynk offers complete lessons and courses on financial education, including tips, educational content and how-tos.

Can I teach myself how to trade?

A stock broker is a financial professional who buys and sells securities on your behalf. Online stock brokers handle your transactions at a discounted cost, so they’re suitable for beginning investors with less money to spend. The best brokerage accounts for beginners are those that feature educational tools, low account fees, and intuitive mobile platforms. TD Ameritrade is one of the most popular brokers in the world, and for good reason. The platform is a great fit for investors who want a well-rounded brokerage experience, great customer support, and lots of account and investment options. TD Ameritrade has excellent educational resources for beginners, several trading platforms for investors of all skill levels, and pretty much every type of brokerage account you can think of.

- You can even get help from an education coach to guide your progress.

- The company’s wide range of investment products, fractional share investing option, and robust research and educational resources make it a strong choice for DIY investors.

- But USAA is unique on this list because you must be either a veteran or an active member of the U.S. military or a family member, to be eligible to open an account.

- Also, consider how much customer support you feel comfortable having access to.

If https://trading-market.org/ a newcomer looking to take your first step into the world of online stock investing, then you’ll want to know which online brokers will benefit you most and help you succeed as a beginner. While several online brokers we’ve discussed require no account minimums, Schwab does require that its investors maintain at least $1,000 with them. It’s a business that often does business out of a physical office where a real person, also known as a stock broker, takes and executes buy and sell orders from clients.

Michael is a certified financial planner and an IRS enrolled agent. Because Revolut allows you to invest in stocks, you can take even greater control over your finances, making it possible for you to create new income streams and build your portfolio. Using Revolut makes it much easier to manage your money instead of using several different apps and trying to bring them together. The Follow Feed feature enables you to see the trades taken by a group of experienced traders, helping you to keep ideas flowing.